Новости криптовалют в мире на сегодня

Содержание:

- Altcoins to Complement Bitcoin in Cryptocurrency Trading

- Coincheck and Bitcoin Suisse

- #4 – Coinbase

- Poloniex Leaves the Decision Up in the Air

- A New Era in Banking

- Telegram Sticker Packs

- Low Latency, Quality Information

- The Promises of United Bitcoin

- Bitcoin.com

- Цена на Биткоин продолжает расти

- How to Participate in the US Government’s Auction

- One Out of Only Two Miners Controls 70% of the Network’s Hashrate

- The Need for Altcoins?

- Bitmex and Exodus Choose to Decline BCC Listing

- Coinbase Acquires Xapo

- The Best 145 Crypto News Websites of 2019

- Fickle Ripple and the Big Freeze

- Moon Rockets: Now Leaving Hourly

- What Globalcoin Means for Cryptocurrencies

- #1 – Blockchain.info

- Competing With Facebook’s Libra

- Binance Announces New Stablecoin Project

Altcoins to Complement Bitcoin in Cryptocurrency Trading

The first way altcoins have complemented bitcoin is with liquidity.  Altcoins with big transaction volumes make arbitrage feasible in the cryptocurrency markets. Investors can trade between bitcoin and other highly transacted altcoins to profit from the price differences.

Altcoins with big transaction volumes make arbitrage feasible in the cryptocurrency markets. Investors can trade between bitcoin and other highly transacted altcoins to profit from the price differences.

The second is by adding anonymity and privacy. Bitcoin transactions are pseudonymous and not anonymous. When an identity is tied to a bitcoin address, then all associated transactions can be linked to it. In the cryptocurrency market, a few altcoins (such as Monero) try to offer more anonymous transactions (but the jury is still out on whether currencies such as Monero are “more private” than others). However, some hardcore bitcoin fans would not hold other altcoins for extended periods despite these additional features, viewing Bitcoin as the gold standard of cryptocurrencies or the reserve currency.

So how can altcoins help bitcoin to anonymize transactions? Bitcoin users can go to exchanges such as Shapeshift.io to exchange their bitcoin to altcoins and back — but to a different bitcoin address. By doing so, the layering of different coin addresses makes tracing of transactions much harder. The existence of altcoins also make any government’s attempt to “ban” bitcoin less meaningful (as there are many alternatives that could replace bitcoin).

Coincheck and Bitcoin Suisse

Allowing users to earn interest via crypto lending, payment of utility bills, and business payment services, Japan’s Coincheck was acquired by mainstream Tokyo brokerage firm Monex Group in April, 2018, for $33.6 million. In the wake of a $534 million NEM heist in January, 2018, and ensuing regulatory overhaul, the exchange has once again become profitable, according to Monex. Monex Managing Director and Chairman Oki Matsumoto recently created even more of a stir when he announced that Monex had applied to join the Libra Association, expressing emphatic interest in the project. The Libra announcement solidified the growing impressions of many that a global synergy toward bitcoin banking is indeed developing more rapidly than ever across the industry.

Other major players include groups like Bitcoin Suisse, founded in 2013 and marketed by the company as “Switzerland’s oldest, regulated, professional company for crypto-financial services.” Bitcoin Suisse offers trading and brokerage, storage, collateralized lending, staking, and the Cryptofranc (XCHF) stablecoin. As an amusing aside, a recent publicity stunt brought the group even more attention, finding them conducting the “highest bitcoin trade ever publicly recorded” on the wind-whipped, snowy summit of Breithorn, Switzerland, at 4,164 meters above sea level.

Exchange.bitcoin.com will launch on Sept. 2, 2019.

Exchange.bitcoin.com will launch on Sept. 2, 2019.

#4 – Coinbase

Overview: Coinbase is a company supplying a wide variety of Bitcoin services such as a Bitcoin wallet, a Bitcoin exchange, merchant payment solutions and also acts as a Bitcoin broker. It is considered to be one of the leading companies in the Bitcoin ecosystem today.

Founded: June 1st, 2012

Employees: 100-250

Alexa Rank: 6532

Est. April 2015 traffic: 2.4 million

Users: 2.4M (39K merchants)

Main audience: US (70%)

Business model: Transaction fees from buyers and merchants.

Apps: Android – Coinbase wallet, Coinbase exchange, Coinbase merchant. iOS – Coinbase wallet.

Facebook Fans: 17,582 fans

Twitter Followers: 52.4K followers

Domain Authority: 66 out of 100

#of websites linking to this site around the web: 439

Additional information:

Founded at Y-Combinator, Received $106.7m in VC funding (complete investor list), Acquired Blockr.io and Kippt.

—————————————————————

Poloniex Leaves the Decision Up in the Air

On July 24 the large cryptocurrency exchange Poloniex revealed its plans to handle the “potential bitcoin network disruption.” The exchange will be halting withdrawals and deposits but will allow trading to continue on August 1. As far as the hard fork is concerned and listing the BCC token on Poloniex, the firm says at this time they “cannot commit to supporting any specific blockchain that may emerge if there is a blockchain split.” From Poloniex’s announcement, it seems the trading platform is leaving it up in the air for now.

“Even if two viable blockchains emerge, we may or may not support both and will make such a decision only after we are satisfied that we can safely support either blockchain in an enterprise environment,” explains the U.S. based exchange Poloniex.

The Chinese exchange Viabtc will support BCC and is currently offering futures trading on the token. At press time one BCC is worth 2800 CNY or $415 USD on July 27, 2017.

The Chinese exchange Viabtc will support BCC and is currently offering futures trading on the token. At press time one BCC is worth 2800 CNY or $415 USD on July 27, 2017.

A New Era in Banking

As the trend toward a new generation of Bitcoin Banks continues to evolve, market demand is likely to force legacy institutions to adapt or die, and inspire renewed focus industry-wide on convenience and transparency. As evidenced by cases like 87-year-old private bank Maerki Bauman in Switzerland, which has seen revived interest after hinting at crypto offerings, the new paradigm is one which is digital asset-friendly.

With major crypto service providers and exchanges taking unique roles in their offerings to the market, currency competition among stablecoins is – at least to some degree – now being encouraged. It will no doubt be evident in years to come which Bitcoin Banks are serious about financial inclusion and bringing about a true revolution in the banking industry, and the unfolding promises to be an exciting spectacle.

What are your thoughts on the new Bitcoin Banks? Let us know in the comments section below.

Images courtesy of Shutterstock, fair use.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

Use Bitcoin and Bitcoin Cash to play online casino games here.

Aug 15, 2020

Aug 13, 2020

Aug 12, 2020

Telegram Sticker Packs

Many of the freshest crypto memes were to be found in Telegram’s trading groups, where the best were collected into sticker packs. Whether it was Pepe gleefully watching markets moon or Drake turning away from red candles in anguish, crypto stickers said more than words ever could.

Whatever 2018 holds for bitcoin, here’s hoping it comes bundled with a flurry of dank memes. Scaling solutions, decentralized exchanges, and atomic swaps are all well and good, but without humor our world of magical internet money would be a darker and hollower place.

What were your favorite bitcoin memes this year? Let us know in the comments section below.

Images courtesy of Shutterstock and the internet at large.

Bitcoin Games is a provably fair gaming site with 99% or better expected returns. Try it out here.

Use Bitcoin and Bitcoin Cash to play online casino games here.

Aug 15, 2020

Aug 13, 2020

Aug 12, 2020

Low Latency, Quality Information

The new feed “initially include data from more than 15 cryptocurrency exchange venues globally,” ICE COO Lynn Martin is quoted as saying, “With the broad array of cryptocurrencies and exchanges, and given the price variances between exchanges, it’s critical that investors have a comprehensive source of pricing information.”

The six cryptocurrencies will be “measured against the U.S. Dollar and other major currency pairs,” the announcement continued. “Blockstream works with cryptocurrency exchanges around the world and consolidates the disparate data sets into a normalized and standardized data source that includes real-time and historical trade information, as well as other relevant order book data such as quantities, prices, currencies, and timestamps.”

Lynn Martin

Lynn Martin

The team’s hope is to limit latency in price discovery, providing as close to real-time and quality information as possible. “The ICE Data Services Consolidated Feed provides access to over 450 normalized real-time market data feeds and is part of ICE’s Connectivity service,” they stress.

It’s too early to know just yet if The Feed will compete with Coinmarketcap and other aggregators already established, but perhaps Wall Street professionals will be drawn to the legitimacy and gravitas ICE brings, furthering the crypto mainstreaming trend.

What do you think this teaming will accomplish? Let us know in the comments section below.

Images courtesy of Pixabay, ICE, Blockstream.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

Purchase Bitcoin without visiting a cryptocurrency exchange. Buy BTC and BCH here.

Aug 15, 2020

Aug 13, 2020

Aug 12, 2020

The Promises of United Bitcoin

A few months ago we reported on the created by Jeff Garzik, his partner at the blockchain company, Bloq, chairman Matthew Roszak, and Bitbank Group’s Songxiu Hua. The team says it plans to create a credit currency system pegged against various fiat currencies alongside a native smart contract feature. The entire network is modeled after the bitcoin core blockchain prior to December 12, and all active wallet holders are able to receive UBTC at a 1:1 rate. The catch is inactive wallets will go towards the UB Foundation to support innovative blockchain development.

A few months ago we reported on the created by Jeff Garzik, his partner at the blockchain company, Bloq, chairman Matthew Roszak, and Bitbank Group’s Songxiu Hua. The team says it plans to create a credit currency system pegged against various fiat currencies alongside a native smart contract feature. The entire network is modeled after the bitcoin core blockchain prior to December 12, and all active wallet holders are able to receive UBTC at a 1:1 rate. The catch is inactive wallets will go towards the UB Foundation to support innovative blockchain development.

Over the past few weeks, the UBTC team have made some videos detailing their project’s goals to be serious cryptocurrency contender. One particular documentary shows Garzik describing why he thinks UBTC can be a digital asset that engages and unites with the entire cryptocurrency ecosystem. “If I could start with a clean slate what technologies would I include?” Garzik asks an audience during the video. Matthew Roszak says that United Bitcoin will encompass three really important pieces technology, community, and tokenomics by relying on cross-industry innovation.

Bitcoin.com

Bitcoin.com’s upcoming exchange (to launch September 2) viewed in combination with the already available non-KYC, P2P local.bitcoin.com trading platform are aiming for mass onboarding of crypto users seeking banking-type services through Exchange.bitcoin.com, while simultaneously providing a clear route for private, permissionless exchange of crypto via the P2P platform.

The exchange is set to offer features such as crypto/fiat on and off-ramps, security via “2FA, IP whitelisting, cold storage,” dozens of trading pairs against BCH, and an SLP token exchange. Bitcoin.com is conscious of financial inclusion as well, including financial sovereignty as the critical element of transaction. As the developer site states:

Цена на Биткоин продолжает расти

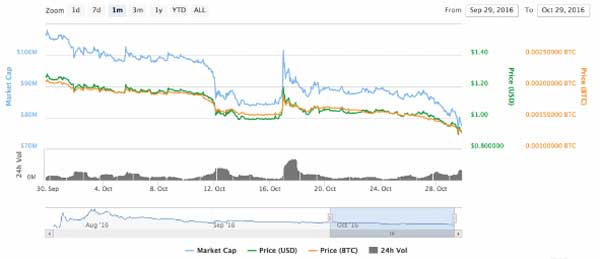

Так как цена на Биткоин продолжает расти, Ethereum, Ethereum Classic и Monero продолжают бороться за удержание своих позиций.

Стоимость на Биткоин продолжает двигаться вверх с 12,5 процентной оценкой роста цифрового актива только за одну неделю. Для Биткоин это хорошая новость, но как чувствуют себя другие криптовалюты?

Ethereum

У Ethereum был набор проблем и до повышения цены на Биткоин. После длительной атаки, транзакции через Эфириум-сеть зашли в тупик из за сильного замедления сети, причем каждая сделка проводилась несколько часов, а то и несколько дней. Криптовалюта, стоимостью в 13долл. США на начало месяца, после периода напряженных скачков, достигла минимума в 10 долл. США. Значение Ethereum за одну неделю упало на 14 процентов.

Ethereum Classic

Криптовалюта Ethereum Classic, ответвление блокчейн технологии Ethereum и создана Ethereum для ужесточения разветвления на блокчейн. Несмотря на один стержень, Ethereum Classic не обладает таким же иммунитетом к некоторым атакам, с которыми сталкивается Ethereum. В течение одного месяца, стоимость Ethereum Classic упала более чем на 26 процентов. Цифровая валюта в начале этого месяца была открыта с 1,26 долл. США. Сейчас ведутся торги на уровне 0,90 долл. США после стоимости в 1.20 долл. США на прошлой неделе. Ethereum Classic также недавно ввел хард форк, с целью противостояния атакам на своей платформе.

Monero

Шестая по величине криптовалюта с точки зрения рыночной капитализации, Monero была кратко рассмотрена в качестве следующей перспективной криптовалюты. Основанный на CryptoNote, Monero известен своей приватностью и анонимностью. Эти особенности привели его к принятию несколькими малоизвестными торговыми площадками. Валюта достигла в прошлом месяце своего пика с уровнем 14,23 долл. США. Тем не менее, этот успех был недолгим. После этого, цифровая валюта потеряла более 65 процентов своей стоимости и спустилась до 4,86 долл. США. Только за последнюю неделю, Monero потерял более 25 процентов в стоимостном выражении.

Стоит отметить, что все три криптовалюты моложе Биткоина. Биткоин существует относительно долгое время и поэтому достиг этой стадии. Благодаря широкому принятию, он получил господствующий статус. Надежда на остальные криптовалюты существует, однако им потребуется достаточное долгое время, чтобы достигнуть теперешнего положения Биткоина.

How to Participate in the US Government’s Auction

To be eligible to bid in the auction, interested bidders must register with the USMS and submit all required documents with deposits. Registration opened on Feb. 3 and will close on Feb. 12. The winning bidder’s deposit will be retained by the USMS and credited towards the purchase price. The deposits of other bidders will be returned to the original accounts from which they were received.

The online auction will take place on Feb. 18 from 8 a.m. to 2 p.m. EST. Bids must be an all-cash offer in U.S. dollars. The announcement details:

However, the government agency warned that “the number of bids received and the complexity of the review process may require additional review time.” The winning bidder must wire purchase funds to the agency by 2:00 p.m. EST on Wednesday, Feb. 19. Failing to do so will disqualify the bidder and another winning bidder will be selected.

Four series of BTC to be auctioned off by the USMS.

Four series of BTC to be auctioned off by the USMS.

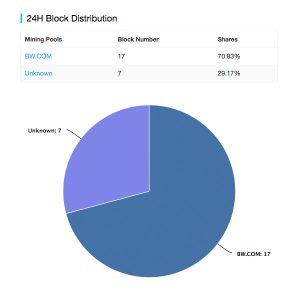

One Out of Only Two Miners Controls 70% of the Network’s Hashrate

So far the network has minimal infrastructure and community support. At the time of publication, there are only two miners who are processing UBTC blocks; an unknown entity and the mining pool BW.com. The mining pool BW.com has more than 70 percent of the network’s hashrate. The network’s total hashrate is only 50,811.47 TH/s and block intervals can range from an hour and a half, to occasional sporadic 20-40 minute blocks. The network has an extremely low amount of users as there are only 20 pending transactions right now. Blocks are averaging roughly 20-100 transactions, and most block sizes are well below 1MB even though UBTC has the capacity for 8MB blocks.

So far the network has minimal infrastructure and community support. At the time of publication, there are only two miners who are processing UBTC blocks; an unknown entity and the mining pool BW.com. The mining pool BW.com has more than 70 percent of the network’s hashrate. The network’s total hashrate is only 50,811.47 TH/s and block intervals can range from an hour and a half, to occasional sporadic 20-40 minute blocks. The network has an extremely low amount of users as there are only 20 pending transactions right now. Blocks are averaging roughly 20-100 transactions, and most block sizes are well below 1MB even though UBTC has the capacity for 8MB blocks.

UBTC has its own full node wallet client for Linux, Windows, and Macintosh operating systems and the source code is available for review. According to the distribution repository, there will also be a lightweight client release soon. There are three other wallets that support the UBTC protocol. As far as exchanges most of them are based in Asia, and a great majority of them are unknown and exchange very little trade volume besides the exchange Okex. At the moment, according to Coinmarketcap statistics, one UBTC is worth $82 USD.

The Need for Altcoins?

With currency wars currently escalating between the worlds major currencies, the last thing the cryptocurrency community needs is a ‘crypto-war’ between altcoin platforms. But as with any open and free market, healthy competition is certainly welcome and provides a great mechanism for selecting the best and most effective cryptocurrency features that may be suitable for inclusion in other cryptocurrencies such as Bitcoin.

Different cryptocurrencies have reasons for their existence. However, altcoins, on the whole, are working towards fairly similar goals — to bring liberty back to people and contribute to the remake of the worlds legacy financial systems.

Bitmex and Exodus Choose to Decline BCC Listing

The cryptocurrency exchange Bitmex is also joining the exchanges that will not support the BCC blockchain. Bitmex says the change is “incompatible” with the current Bitcoin ruleset and the trading platform may be unable to protect the new BCC tokens on behalf of clients.

“As such, Bitmex will not support the split or distribution of Bitcoin Cash, nor will Bitmex be liable for any Bitcoin Cash sent to Bitmex,” the company’s blog explains. “Therefore, it is up to our users to withdraw from Bitmex prior to August 1st if they wish to access Bitcoin Cash tokens or any other hardfork.”

Read some of our previous articles on the possibility of a blockchain split here and here.

Read some of our previous articles on the possibility of a blockchain split here and here.

The wallet and built-in exchange platform Exodus says they will not embrace the BCC token either. However, Exodus users will be able to import their keys into a BCC compatible client and retrieve their hard fork holdings after the split. The company highly recommends not using bitcoin during the fork and tells customers they should patiently wait for the protocol change to end. Similarly, the bitcoin wallet provider BTC.com will also provide a tool for those who wish to extract their Bitcoin Cash from the BTC.com wallet.

Coinbase Acquires Xapo

Another giant in the industry serving as a significant crypto on-ramp since 2012, is Coinbase, whose custody business has recently acquired crypto asset storage group Xapo’s Institutional Custody Business. In an announcement on August 16, Coinbase detailed: “Through the acquisition of Xapo’s institutional businesses, we’re now proud to act not only as the gateway for millions of people to cryptocurrency, but also as the world’s largest and most trusted steward of digital assets.”

Coinbase Assets Under Custody (AUC) growth chart. Source: https://blog.coinbase.com

Coinbase currently provides crypto services supporting 42 countries worldwide, with over 20 million customers globally. The group’s main service is facilitating the buying and selling of bitcoin via bank account, credit and debit card. Like Binance, Coinbase has its own stablecoin, USD coin (USDC). The overarching selling point of all of stablecoins across the industry is strikingly similar: a focus on convenience and reliability. As Coinbase claims, emphasizing financial inclusion:

The Best 145 Crypto News Websites of 2019

The cryptosphere is filled with news sites that cover multiple cryptocurrencies, ecosystems, and angles. From the unquestioningly fawning to the unrelentingly skeptical, there’s a crypto news outlet to suit all dispositions. ‘Best’ is a highly subjective term, therefore, whose declaration largely depends on the needs of the reader. Nevertheless, when BTC Peers published its methodical analysis of the top 145 crypto sites and placed news.Bitcoin.com top, our publication was duty bound to report on the matter.

“News.bitcoin.com won first place with 978 points,” notes the report, adding: “It was interesting to compare it with Cointelegraph. On the one hand, CT has a higher Alexa Rank, with more than twice the audience and more backlinks. But news.Bitcoin.com has less of a bounce rate and a twice higher avg. visit duration, which suggests that although they have a smaller audience, their readers interact with the content better and longer.”

In other words, news.Bitcoin.com may not attract the highest readership, but the increased time readers spend on the site is indicative of quality long form content. Other sites may be good for grazing, but for deep analysis, news.Bitcoin.com has got it locked down. That’s the long and short of the BTC Peers report. Naturally there are a few caveats to consider.

Fickle Ripple and the Big Freeze

There are no words.

There are no words.

Everyone had a lot to say about ripple this week: we certainly did, detailing the token’s rise and rise, as well as examining the rumors that Ripple can freeze accounts. Ripple’s army of believers had a lot to say too, in the comments, on social media, and anywhere else they could make their voices heard. The week was sealed with Eric Wall examining ripple and its “one simple trick” in his trading column yesterday.

The week began with everyone still talking about ripple and whether, on bitcoin’s 9th birthday, it could overtake bitcoin to create The Rippening, but Stellar – developed by former Ripple cofounder Jed McCaleb – has also been on a roll. Then again, what hasn’t? There’s going to be a lot of people smarting when all these vaporwares and shitcoins crash and burn, but while bitcoin idles, silly season is showing no sign of letting up.

Moon Rockets: Now Leaving Hourly

As the meme on 4chan’s /biz/ messageboard runs, “He missed bitcoin. He missed ethereum. Surely he won’t miss ”. There was a lot of FOMO flying about this week, as “investors” (okay, gamblers) piled into the next thing that was going to make them filthy rich, or at the very least provide an easy 2x before they dropped it like a stone and moved onto the next 2x thing.

It’s hard to define the point at which we hit peak silliness this week. Was it when Tron, a platform with no product and no code, reached a $16 billion valuation? Was it when pre-mined Ripple’s founder became the 15th richest man in America? Or was it when heavily shilled ICO Dadi was found to have plagiarized half of SONM’s white paper and engaged in shady practices, only for some investors to shrug “Meh, it’s only got a $30 million cap. Can probably still make 300% if I flip it quick”? Even by crypto standards, this week’s been a weird one – and that’s before we get to discussing body suits that can mine cryptocurrency.

What Globalcoin Means for Cryptocurrencies

As for what GC means for crypto, there are essentially two schools of thought. One holds that GC holds a genuine threat in giving the masses the benefits of crypto – fast settlement, low fees, wrapped in a package that even grandma can understand – with none of the downsides, such as volatility, complexity, or the irreversible loss of funds. In this paradigm, GC will replace BTC as a medium of exchange (MoE), leaving bitcoin to serve as a store of value (SoV) and for payments that fall outside of Facebook’s purview – like buying drugs. If this comes to pass, then GC could also threaten other cryptos such as BCH, LTC, and DASH.

The other school of thought holds that Globalcoin will serve as a Trojan horse, or gateway drug, to ”real” cryptocurrencies. Through normalizing the use of digital currency, it will make the transition to permissionless crypto seem less scary, ensuring that bitcoin is primely placed to onboard the masses when they tire of GC’s limitations: the privacy concerns, the data abuses, and the limited means of spending. In this context, Zuckerberg’s vanilla crypto will get bested by bitcoin, which can outmuscle it on all fronts, save for network effects. With an estimated 30 million cryptocurrency users versus 2.4 billion Facebook users, Globalcoin will launch with a massive advantage.

Love, hate, or fear it, Globalcoin merely represents the inevitable evolution of money. The majority of our spending has already gravitated to the digital realm, be it Paypal, Apple Pay, Visa, Venmo or bitcoin. With the underlying payment network being abstracted away while cash dies a slow death, Globalcoin will take a seat at the table of digital payment solutions, despite offering nothing new. As has been reiterated many times over, bitcoin doesn’t need to take over the world to succeed: it simply needs to survive, in one form or another. It is highly probable that Globalcoin will gain more users in its first month than bitcoin ever has or ever will. That metric, however, is meaningless.

What are your thoughts on Globalcoin? Let us know in the comments section below.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

Use Bitcoin and Bitcoin Cash to play online casino games here.

Aug 15, 2020

Aug 13, 2020

Aug 12, 2020

#1 – Blockchain.info

Overview: Blockchain.info supplies a free hybrid wallet for Bitcoin users so they will be able to store their Bitcoins and access them from anywhere in the world. It also serves as a very popular block explorer.

Founded: August 28, 2011

Employees: 29

Alexa Rank: 3641

Est. June 2015 traffic: 4M

Users: 3.8M

Main audience: United States (29%)

Business model: Ad revenue on homepage

Apps: Andriod App, iOS App, ZeroBlock, Blockchain merchant, block explorer

Facebook Fans: 18,664

Twitter Followers: 58.5K

Domain Authority: 67 /100

#of websites linking to this site around the web: 914

Additional information:

$30M raised from the leading investors in Silicon Valley, Wall Street, and London.

—————————————————————

Competing With Facebook’s Libra

The project is dubbed by some as a rival to Facebook’s Libra project, which has been scrutinized by regulators worldwide since it was first announced. The Libra project is currently considering redesigning as several key members have left the project, including Paypal, Visa, Mastercard, Stripe, Mercado Pago, Ebay, and Vodafone.

Kimble claims that “There are some similarities in terms of mission, which is why there are some people who have joined both alliances.” Some Celo Alliance for Prosperity members that are also Libra supporters include Anchorage, Bison Trails Co., Coinbase Ventures, Andreessen Horowitz and Mercy Corps. However, the Celo project does not have the massive userbase that Facebook has.

Some compare the Celo project to Facebook’s Libra. According to Anchorage, a member of both projects, “Celo and Libra each have unique focuses and approaches, but they share a goal that Anchorage strongly believes in: banking the unbanked.”

Some compare the Celo project to Facebook’s Libra. According to Anchorage, a member of both projects, “Celo and Libra each have unique focuses and approaches, but they share a goal that Anchorage strongly believes in: banking the unbanked.”

Payments in the Celo Dollar stablecoin can be sent to people’s phone numbers rather than complicated addresses, Tech Crunch noted, asserting that “The goal is to make delivering utility via blockchain easier by building a flexible network of applications that doesn’t scare regulators like Libra has.”

Kimble claims, “We have met with governments around the globe as well as central banks, we are continually engaging with governments in the many countries which we hope to serve.” Diogo Monica, president of Anchorage, which is a part of both the Libra project and the Celo Alliance for Prosperity, said in a statement:

What do you think of the Celo project? Do you think regulators worldwide will have a problem with it like they do Facebook’s cryptocurrency? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock and the Celo Foundation.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

Spot-markets for Bitcoin, Bitcoin Cash, Ripple, Litecoin and more. Start your trading here.

Aug 15, 2020

Aug 13, 2020

Aug 12, 2020

Binance Announces New Stablecoin Project

On Monday, Binance announced “plans to initiate an open blockchain project, Venus, an initiative to develop localized stablecoins and digital assets pegged to fiat currencies across the globe.” The $1 billion+ daily trading volume behemoth is supporting over 150 cryptocurrencies and already actively involved in stablecoin development “including a BTC-pegged stablecoin (BTCB) and the Binance BGBP Stable Coin (BGBP) pegged to the British Pound.”

The Chinese version of the announcement stressed the need to embrace change, and for groups like itself and Libra to be developed in an “orderly manner” under regulatory guidelines. The announcement goes on to suggest three specific courses of action including government establishing the strategic position of blockchain and stablecoin enterprise in the financial sector, establishing regulatory sandbox mechanisms, and the allowance of private enterprise creation of stablecoins and cross-border payment settlement systems.